For a year and a half, representatives from the real economy, the financial sector, academia and civil society fought hard to reach an agreement on how Germany could become a prime hub for sustainable finance.[1]

On February 25, the final report of the German government's Sustainable Finance Advisory Council (SFB) was published, with ambitious recommendations on how to make the financial market more sustainable: Shifting the Trillions - A Sustainable Financial System to facilitate the Great Transformation. It is now the government's turn to translate the recommendations into an effective strategy and initiate the first legislative changes before the end of this legislative term.

Shifting the Trillions: The financial market and the climate crisis

As part of the Paris climate agreement, the German government not only agreed to limit global warming to 1.5°C, but also to redirect all global financial flows accordingly. After all, meeting the climate targets will require a far-reaching shift in our economic and production methods to build greenhouse gas-neutral economies. Significant contributions to this will be:

- Pricing in climate risks (including those with longer-term effects) and overcoming the tragedy of the horizon to the benefit of financial market stability, as well as

- the reallocation of the necessary capital to finance the transformation.

The prerequisite for this is a binding political framework and clear goals so that the real economy and finance alike can respond in the best possible way and in turn they themselves develop long-term strategies. This can only succeed through the following three cornerstones, which we call the "golden triangle of transformation":

- Reporting requirements: these ensure transparency and comparable information about corporate strategies and how businesses are affected by climate risks, as well as the ecological and social impact of businesses’ own actions, so that the financial market can respond accordingly.

- Incentive pricing (e.g. of CO2): this should reflect social and environmental realities and make external costs visible.

- Coherent political action (esp. binding targets): this includes a leadership role for the federal government in tax, budget and subsidy policy – including public financial institutions.

A prime hub for sustainable finance? Can Germany still achieve it?

If the German government is serious about its self-imposed goal of making Germany a prime hub for Sustainable Finance, the Federal Ministry of Finance must make the implementation proposals as concrete as the Advisory Council's final recommendations. To this end, the timelines proposed in the Advisory Council's report should also be taken seriously.

Germany's Mittelstand faces a significant transformation to be able to respond to the climate crisis. Only if Germany is among the early adopters of sustainable finance will this translate into a competitive advantage for the German Mittelstand. Ambitious requirements from Brussels will come anyway. The European Commission is in the process of revising its "Action Plan on Sustainable Finance" which has been presented back in 2018. The EU taxonomy, which acts as an assessment framework for sustainable investments, and the revision of the directive on the disclosure of sustainability risks (Non-Financial Reporting Directive) [2]

are an essential part of this. The Advisory Council developed its final recommendations keeping the EU-level requirements in mind. Hence, if the Council’s recommendations are implemented to their full extent, they will grant Germany a position as a leader in sustainable finance.

Yet, the global competition is already on. Other states are already setting the tone and creating competitive advantages for their respective constituencies. Great Britain is making the implementation of the TCFD (Task Force on Climate-related Financial Disclosure) recommendations mandatory. The new Biden administration in the U.S. has greater freedom in sustainable finance than in other areas, where they are more dependent on the Senate. Effectively, they are working on an executive order on climate risk disclosure regulation. Japan and China are working on their own taxonomies for sustainable investments.

In light of the federal elections this fall and the upcoming election campaign, it remains to be seen whether the current German government will still deliver. In the Advisory Council, there is agreement that time is of the essence. First steps by means of the Sustainable Finance Strategy must be taken now. However, what exactly did the Advisory Council recommend and what elements need to be tackled now?

Recommendations of the Sustainable Finance Advisory Council - Leveraging the transformation

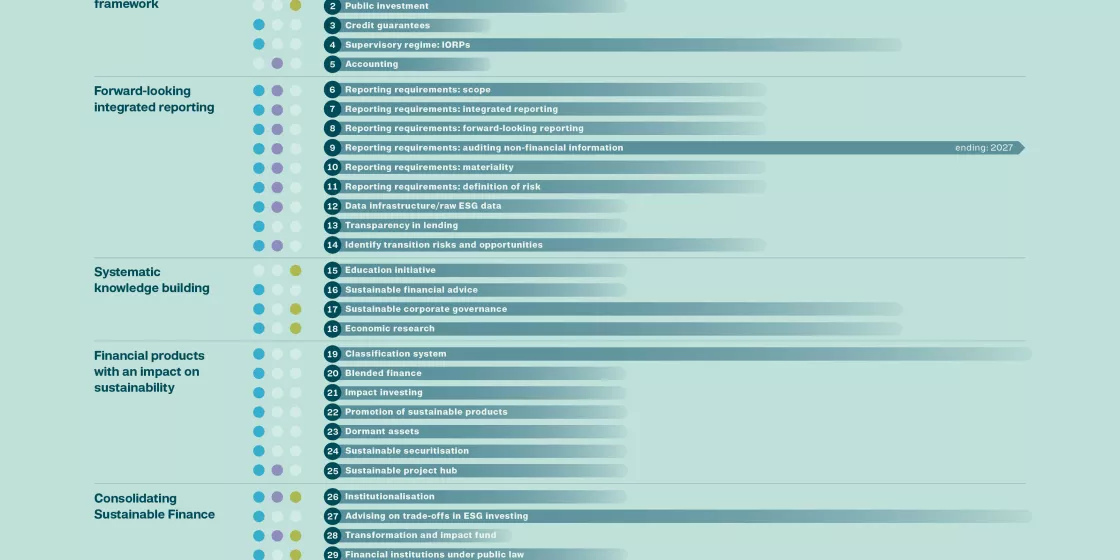

The German government has a very good blueprint for a sustainable finance strategy in the form of the Advisory Council's final recommendations: clear, solution-oriented proposals for decisive action by the German government, covering 31 areas for action and addressing the issue of sustainable finance holistically.[3]

In addition to the aforementioned framework for greater transparency in corporate reporting, the recommendations deal with, among other things:

- Public expenditures and investments,

- public financial institutions,

- the role of sustainable (ESG) financial products,

- transformative collaboration between finance and the real economy,

- supporting structures,

- the broad field of education and corporate governance and

- possibilities to institutionalize the Advisory Council permanently as a consultative body in the implementation of the recommendations.

If implemented consistently, the recommendations proposed by the Sustainable Finance Advisory Council can leverage the great potential of finance and the real economy for the success of the transformation. The final recommendations are comprehensive, detailed and, despite various compromises, ambitious. They aim specifically at various target groups and include timetables for implementing individual recommendations. Three areas of action offer particularly great potential for a successful transformation:

- Forward-looking, integrated reporting on climate and sustainability risks,

- the leadership role of the public sector and public-sector banks and

- a comprehensive approach to education and a corresponding review of corporate management.

Transparency and disclosure of climate risks

To overcome the “tragedy of the horizon”, a longer-term perspective on companies and investments and how they are affected by climate and sustainability risks is required. Only through comparable disclosure of relevant data will this be possible and allow the financial market to make adequate investment decisions.

The SFB considers the adjustment of reporting requirements on climate risks and mitigation or adaptation strategies as one of the most urgent fields of action and the greatest lever. Although the current legislation obliges large capital market-oriented companies (<500 employees), banks and insurance companies to provide so-called non-financial reporting, this relates to past and status quo-related data and has hardly any steering effect. Additional initiatives are based on voluntary efforts – with similar success. To be able to systematically account for climate and sustainability risks, there is a need for binding and comparable reporting by the breadth of the real and financial economy. The EU is working to expand and standardize reporting requirements in this regard. The Council recommends the following:

- A forward-looking reporting based on the recommendations of the Task Force on Climate-related Financial Disclosure – developed on behalf of the G20 – to reflect future risks appropriately.

- The scenarios used for forward-looking reporting be comparable with each other and take into account the current policy targets (GHG neutrality by 2050), while being appropriate for the individual companies and sectors. There also needs to be an ambitious stress test scenario, based on a 1.5°C pathway, against which companies need to test their resilience.

- Based on the analysis of stress test scenarios, companies need to report on their strategies, actions and targets to manage the risks and become GHG neutral by 2050 at the latest.

- In addition to the risks that affect the company and its business activities from the outside (outside-in), the impacts of business activities on the environment and society (inside-out) must also be measured. Consequently, the concept of materiality ("What is material for reporting") must also be adapted accordingly.

- The management or financial reports need to address the contents described above (1-4) and the reports need to be checked in accordance to these criteria.

- Non-capital market-oriented companies with 250 or more employees and companies in so-called high-risk sectors, i.e. those with a high relevance for the transformation, such as the energy sector or heavy industry, must also comply to the criteria above (1-5). For small and medium-sized companies, the Council proposes a slimmed-down set of core indicators on climate data that can be reported with little effort.

Knowledge building and corporate governance

The Council emphasizes that the corporate culture has to adequately reflect new requirements arising from climate and sustainability risks. The ultimate goal is to elevate environmental and socially relevant factors (ESG criteria) from its current niche and anchor them in the corporate strategy. To this end, the Council recommends training programs and obligations for employees, management, board members and supervisory board members, as well as comprehensive reforms on education and training. In addition, the Advisory Council also declared the topic of governance as such as a field of action. Last but not least, the Council recommends that the criteria for bonus payments should be modified to take into account climate and sustainability targets anchored in the corporate strategy.

Public-sector budgets and public-sector banks as pioneers

So far, the federal government has rarely set a good example. There is one or the other positive development and approach, as well as a growing awareness for climate and sustainability risks, but there has been no systematic approach to sustainable finance. In developing a sustainable finance strategy, the federal government cannot avoid reflecting on its own role and taking a lead. In addition to recommending actions for the private sector, the SFB therefore also addressed what the federal government should do to act (1) in accordance with the requirements for the private sector and (2) in accordance with its own climate and sustainability goals and commitments. To do so, the Council recommends:

- the federal and state governments to introduce climate targets and pathways for their budgets, which should guide the allocation of public funds. The starting point for a climate quota for public spending would be 40%. In addition, an appropriate monitoring mechanism should be introduced to support verifying climate reporting and the implementation of the European Green Deal and the SDGs.

- the federal government's investment policy, e.g. for special funds (utility funds and reserves), to have a concept that establishes coherence with its own policy goals.

- public financial institutions to use their great potential to test methods for reporting formats and to counteract possible private sector reluctance by demonstrating solutions and pilot projects. The institutions' own strategies must be consistently aligned with the 1.5°C target, for example.

- financial institutions acting on behalf of the common good – savings banks, Landesbanken, DEKA or public insurers – to review and adapt their business practices in line with climate and sustainability goals.

The federal government and political parties must finally understand how great the benefit of Sustainable Finance is for a future-proof economy. The Sustainable Finance Advisory Council, which notably included representatives from private and financial sector, has presented a framework to policymakers on what real economy and financial sector need to future-proof. There are great expectations that the current and the next federal government will now translate this framework into law and thereby pave the way for a sustainable future development.

[1] According to the mandate of the State Secretary Committee for Sustainable Development from 2019-02-25

[2] Find out more on the topic of NFRD in our new series: Full Disclosure: Monthly briefing on EU corporate transparency regulation

[3] No agreement could be reached on a few areas for action, such as the extension of the short-term horizon in the insurance industry. The Advisory Board intends to continue working on these issues in one form or another. Its institutionalization is currently being discussed between the Advisory Board and the relevant ministries.